does california have real estate taxes

The best way to avoid capital gains tax on the sale of your California residential real estate is to take full advantage of the exemption. California real property owners can claim a 7000 exemption on their primary residence.

Property Tax Calculator Estimator For Real Estate And Homes

Some areas even have an added city tax.

. In California a single taxpayer can save up to 250000. You must have an annual income of less than 35500 and at least 40 equity in your home. California taxes non-residents on CA-source income.

The amount is based on the assessed value of your home and vary. You can pro-rate any unpaid property taxes with your buyer until you finish the escrow on the house sale. 074 of home value.

However California residents are subject to federal laws governing gifts during their lives and their estates after. The tax rate is 1 of the total. Federal Estate Tax.

Theres also an added county tax depending on where the purchase takes place. Tax amount varies by county. A capital gain from the sale of real estate located in CA is CA-source.

California does not have an inheritance tax estate tax or gift tax. That means taxes are calculated by the value of the home. California does not levy a gift tax.

You should claim the. For the State the law is written. The federal estate tax goes into.

This reduces the assessed value by 7000 saving you up to 70 per year. The State regulations regarding withholdings on real property sales is a little different from the Federal withholding of foreigners under the FIRPTA guidelines. There is no one senior-friendly option in California when it comes to property taxes but seniors may be able to claim the standard California write-offs as well as certain.

In California the sales tax on new and used vehicles is 725. The median property tax in California is 283900 per year for a home worth the median value of 38420000. No California estate tax means you get to keep more of your inheritance.

October 2 2019 921 AM. However the federal gift tax does still apply to residents of. Homeowners age 62 or older can postpone payment of property taxes.

Interestingly California has property taxes that are below the. Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider. Property taxes or real estate taxes are paid by a real estate owner to county or local tax authorities.

Property tax in California is calculated by something called Ad Velorum.

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

California Property Tax Changes To Parent Child Exclusion Real Estate Land Use Environmental Law Blog

Calif Courts Create Tax For Llcs Holding Real Estate Corporate Direct

How Is Tax Liability Calculated Common Tax Questions Answered

County Of Marin Department Of Finance Where Your Property Tax Dollars Go

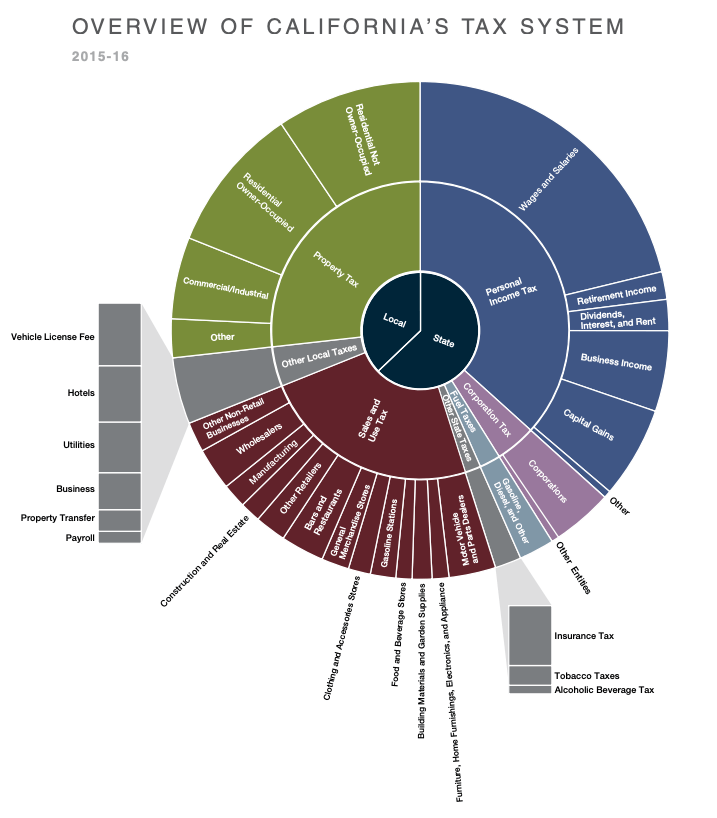

California Tax Rates Rankings California State Taxes Tax Foundation

The Property Tax Inheritance Exclusion

San Diego Property Tax Rate San Diego Real Estate Taxes Welcome To San Diego

Column A Tax On High End Real Estate Sales Is Gaining Steam Los Angeles Times

Where Property Taxes Go Monterey County Ca

Understanding California S Property Taxes

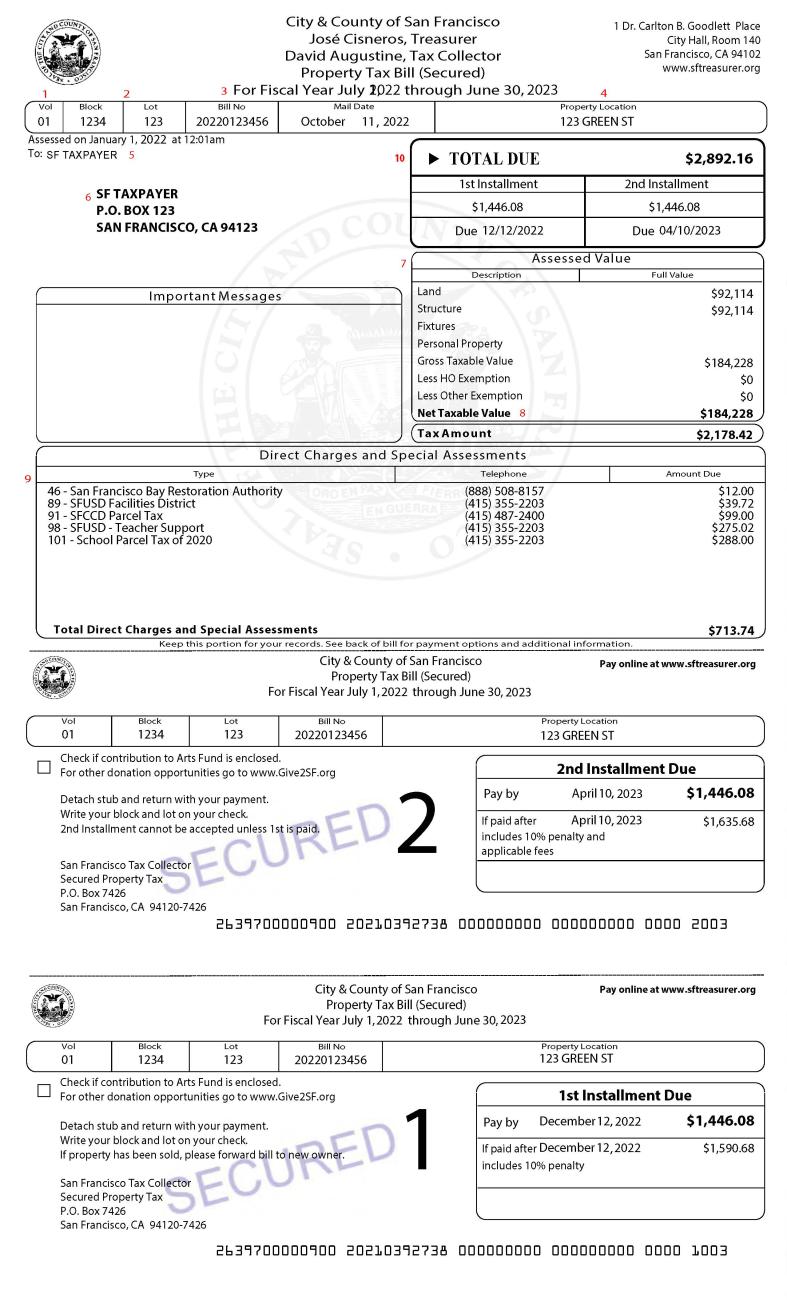

Secured Property Taxes Treasurer Tax Collector

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

The Ultimate Guide To California Real Estate Taxes

California Prop 19 Results Property Tax Changes For Seniors Cbs8 Com

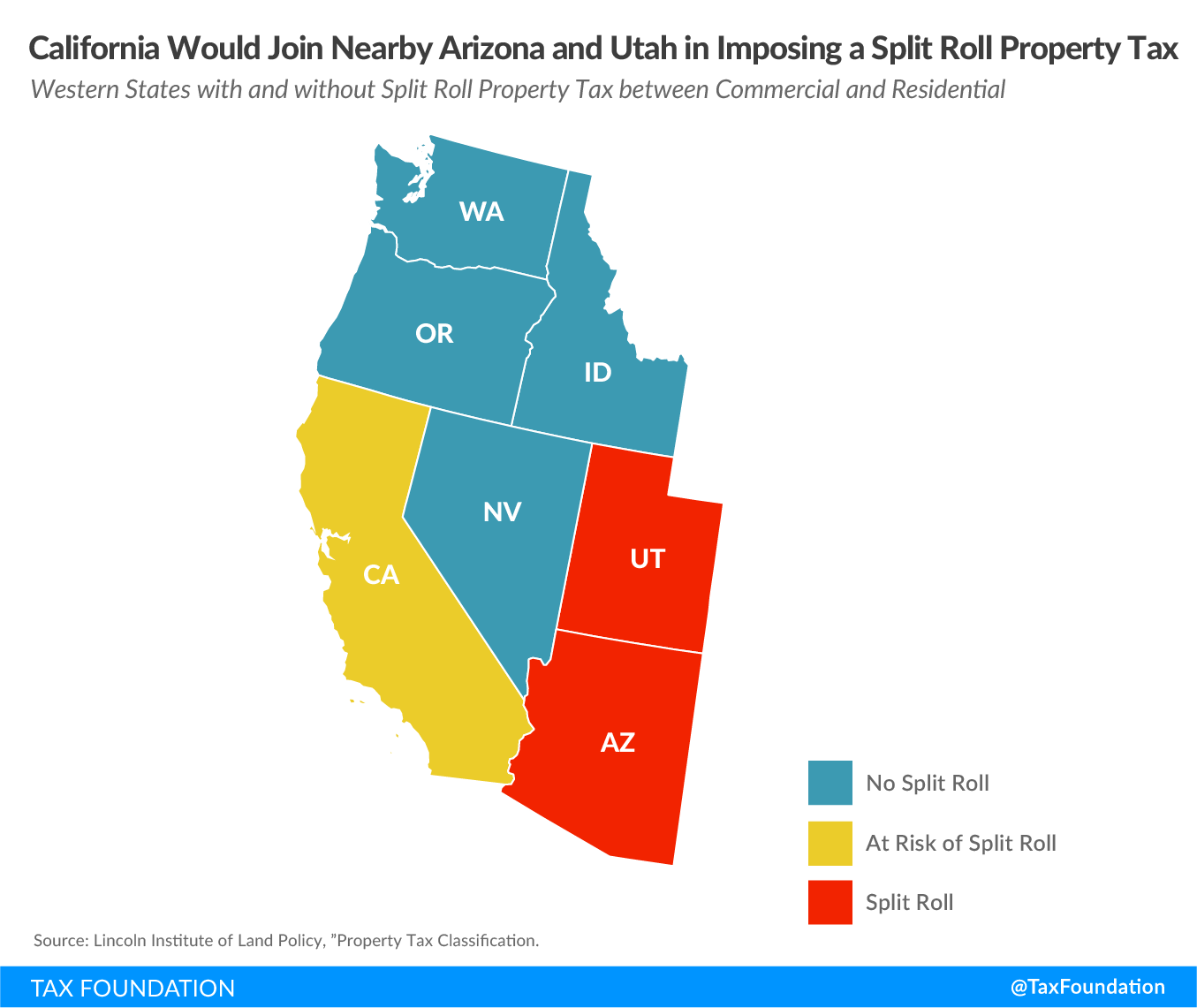

California Proposition 15 Split Roll Property Tax Initiative Tax Foundation

General Facts About Real Estate Tax In California

California Limits Property Tax Deduction To Well Taxes Firsttuesday Journal